Since the release of its comprehensive EV Report, which was issued last fall, Cloud Theory has been keeping a close eye on the electric vehicle sector of the market.

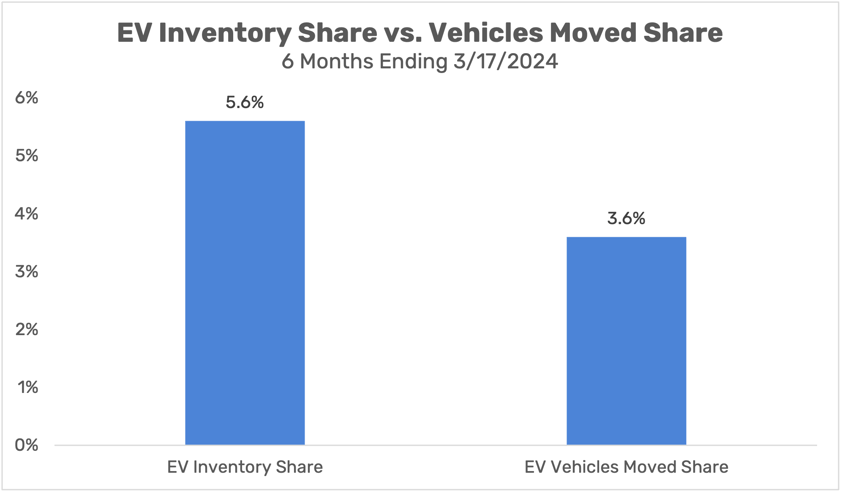

In that report, we noted how the aggressive pursuit of EV production led to a situation where (non-Tesla) inventory share had begun to separate itself from vehicles moved share. In other words, supply exceeded demand. And in the six months since, the situation has not strayed from that disequilibrium, with that gap now at two full points.

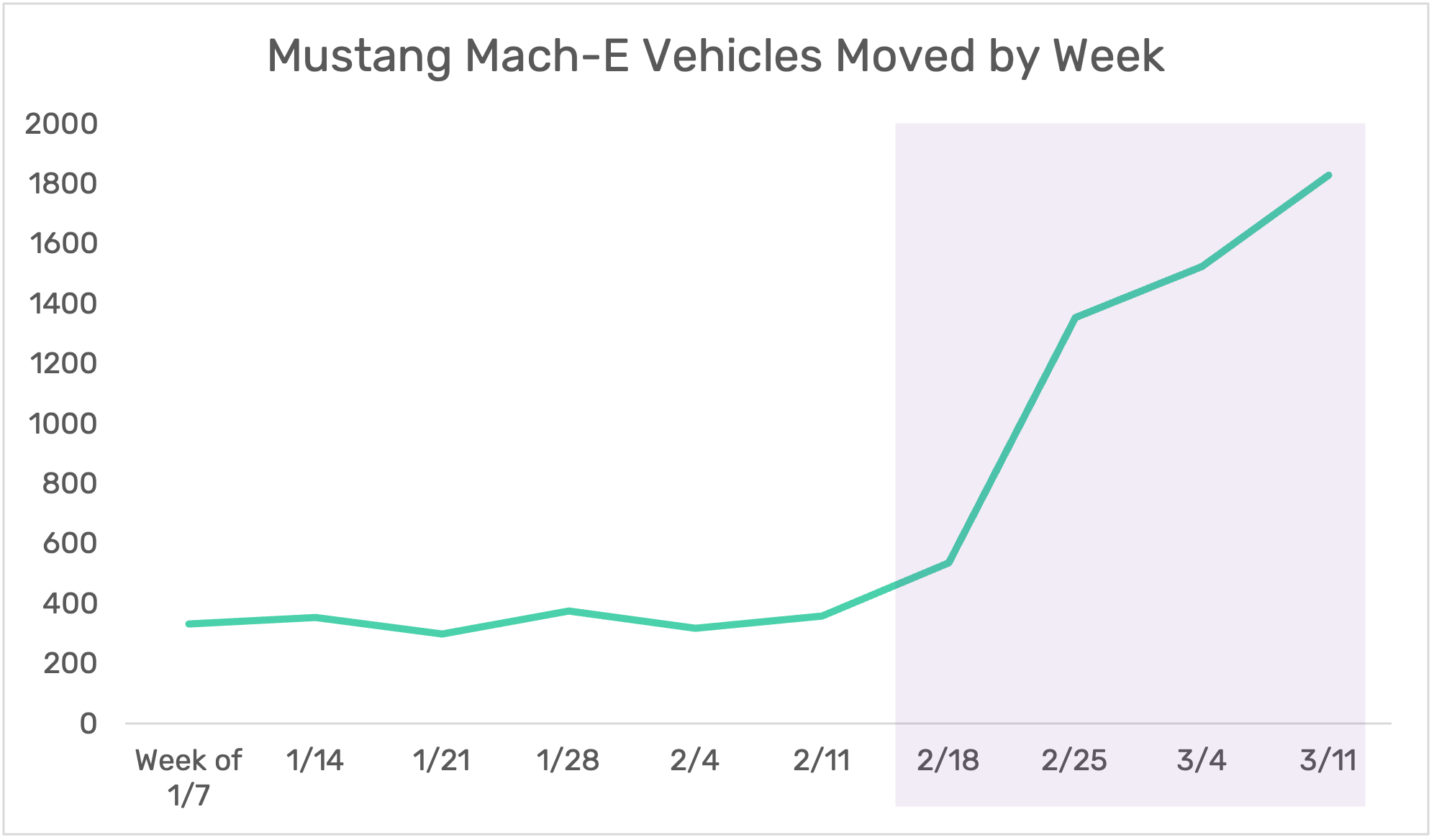

But a notable exception to this macrotrend has emerged in the past 30 days, indicating that consumers are still open to EVs if the overall cost equation can be made attractive enough. On February 20, Ford announced a significant price reduction on its Mustang Mach-E and aggressive financing and leasing incentives to sweeten consumer deals.

The effect on model movement has been dramatic and immediate. Weekly counts, which had been in the 300s, jumped meteorically to above 1,000 (and to more than 1,800 in the latest week). And over the past 30 days, Mustang Mach-E almost tripled its vehicle-moved share within the EV space, rising from 5.2% to 13.3%.

Ford’s actions—and consumers’ reactions to them—show that EVs still have strong potential in the marketplace. (It doesn’t hurt that - in my humble opinion - the Mustang Mach-E is not just one of the most attractive EVs on the market, but one of the most beautifully designed vehicles in general).

But while all that is true, these results do still have some dark clouds that accompany the silver linings.

First of all, OEMs—including Ford—have grappled with how to sell their EVs profitably, and these most recent shifts do nothing but perpetuate those struggles by relying on substantial pricing reductions to achieve these outcomes.

Secondly, other metrics should temper the assessment of Mach-E’s recent success. Prior to these pricing shifts, turn rate—the percentage of vehicles in inventory that moved in a 30-day period—had been at a remarkable low of just 6%. The current surge pulled that number up to a more respectable 26%, which is still modest compared to ICE and hybrid vehicles. And days-to-move, which determines how long a vehicle is marketed to consumers before it is sold, remains highly elevated at 176 days.

The industry’s move towards EVs will continue to face demand hesitations, profitability challenges, and regulatory adjustments. It’s a given that the next decade will be fraught with uncertainties and obstacles to overcome.

But at least for today, let’s celebrate the silver linings of the Mach-E’s results, even as we acknowledge the broader picture that forms their backdrop.