Learn How Cloud Theory's Horizon platform predicts vehicle movement by make, model, or fuel type 30 days in advance.

“Study the past, if you would divine the future.” – Confucius

In our past Cloud Theory blog posts, we have often focused on the real-time nature of our data and insights, and with good reason. Understanding the current inventory of vehicles at dealerships and how efficiently they are selling right now, is essential for making informed decisions about marketing strategies and the allocation of incentive funds.

But what is equally important is to get ahead of that curve and project where vehicle movement is heading over the next 30 days. Knowing the supply and demand levels, as well as the trends from the recent past to the present, fuels a unique outlook of which segments, makes, models, and fuel types will be the likely winners in the next month.

Cloud Theory’s Market Forecast metric does just that. By looking at our Average Inventory and Turn Rate metrics and trends, we can forecast where Vehicle Movement is expected to land over the next 30 days. By comparing those projections to sales over the past 30 days, we can identify predicted trajectories and industry dynamics.

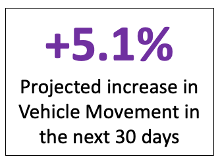

At the highest level, our data points to a projected 5.1% increase in Vehicle Movement in the coming 30 days. This projection is driven by a 9% MoM jump in Average Inventory, coupled with a 2% degradation in Turn Rate over the previous period.

Having a 10,000-foot view of where the market is heading is good, but understanding the pushes and pulls at more granular levels is even better. To that end, let’s look at the players that are expected to see the most positive changes in the next month.

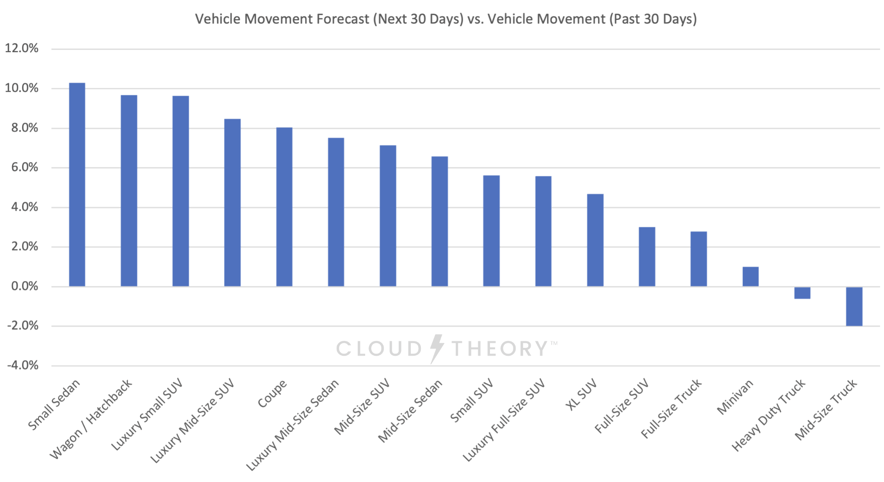

Segments that are expected to turn faster in the next 30 days

The three segments that are expected to see the most positive momentum are Small Sedans, Wagons/Hatchbacks, and Luxury Small SUVs. In contrast, segments such as Full-Size Trucks (+2.8%) and Full-Size SUVs (+3.0%) are expected to grow at slower rates in the next 30 days. In the case of Small Sedans, this strong forecast is related, in large part, to the largest MoM increase in segment inventory—up 33.7% in the past 30 days—accompanied by a moderate decline in Turn Rate (-9.3 points). It may also be true that ongoing high fuel prices are driving consumers to move towards more fuel-efficient options.

Makes and Models Expected to Grow Fastest in the next 30 days

The makes that are expected to grow the fastest in the coming 30 days include several that Cloud Theory has identified as recurring top Inventory Efficiency Index scoring brands—Subaru, Lexus, Honda, BMW, Kia, and Hyundai. But it also points to other makes that are demonstrating positive momentum from lower down on the efficiency list—Genesis, Acura, Volvo, and Mazda.

Note that many of the models that are driving this forecasted growth are fuel efficient vehicles, which is also true for the segment level information summarized above. While inventory growth is playing a role in these projections, it is also likely that persistently high fuel prices are contributing to these dynamics as well.

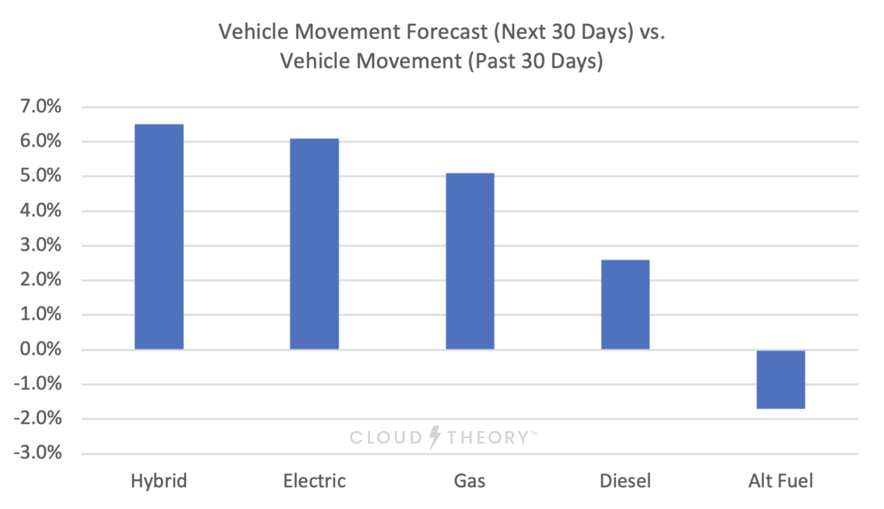

Fuel Type

While it does appear that consumers are gravitating towards fuel efficiency—and there is a small advantage in the projected growth for hybrid and electric vehicles—gas-powered choices are also projected to grow by a similar amount in the coming 30 days. The models driving make-level growth noted above, representing ICE, hybrid, and electric vehicles, reflect the varied choices that consumers have.

Although projections are never perfect, having insights to where the market is heading is a valuable accompaniment to understanding its present position. Knowing what just happened in a competitive context and using that knowledge to predict what will happen next is a beneficial combination that marketers and incentive planners should take full advantage of.

Or said another way, they would benefit from following the wise words of Confucius and divine the future by studying the past.